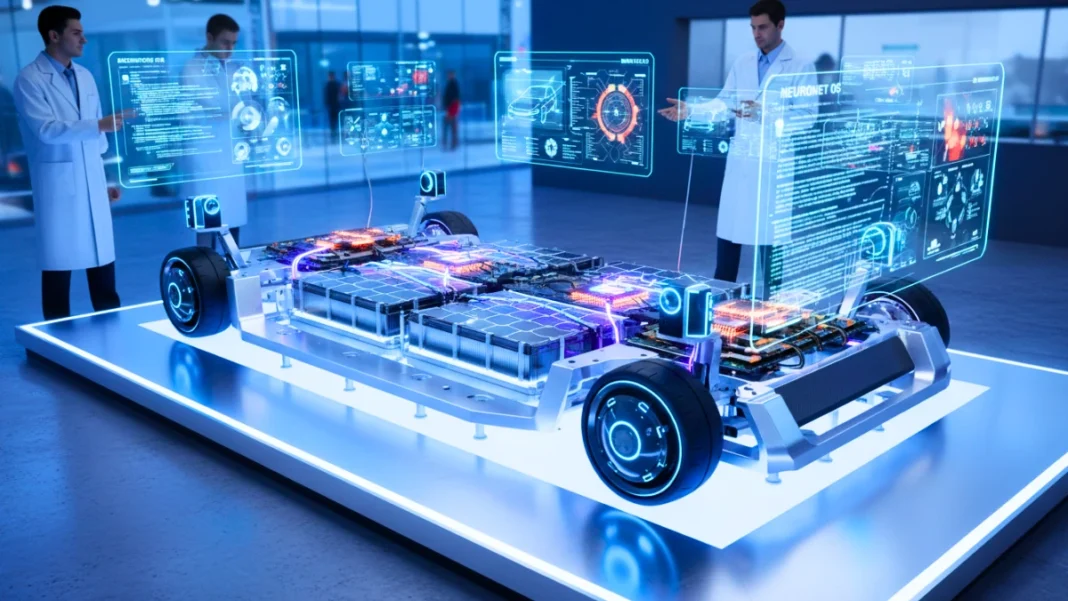

The automotive industry is in the middle of one of its fastest, most consequential technology revolutions. Electrification, autonomy, connectivity, and software-defined features are reshaping how cars are designed, sold, and serviced. For investors, entrepreneurs, fleet managers, and auto enthusiasts, 2025 presents clear opportunities: some product categories are maturing, others are just finding product-market fit, and a few are primed for explosive adoption. This article walks through the most promising automotive technology products to consider for investment in 2025, why they matter, and what to watch for when evaluating companies or products in each category. These innovations align with broader electric vehicle technology trends that are accelerating the shift toward smarter, cleaner, and more connected mobility.

Table of contents

Why 2025 is a pivotal year

Policy, supply chains, and consumer demand have been converging toward cleaner, smarter vehicles. Governments continue to push emissions reductions and EV adoption; chip and battery supply constraints have eased compared with earlier years; and the software and data business models that underpin connected mobility are becoming profitable. These forces make 2025 a sweet spot for investing in hardware and software products that enable EVs, autonomy, connected services, and vehicle cybersecurity.

Top automotive technology product categories to invest in

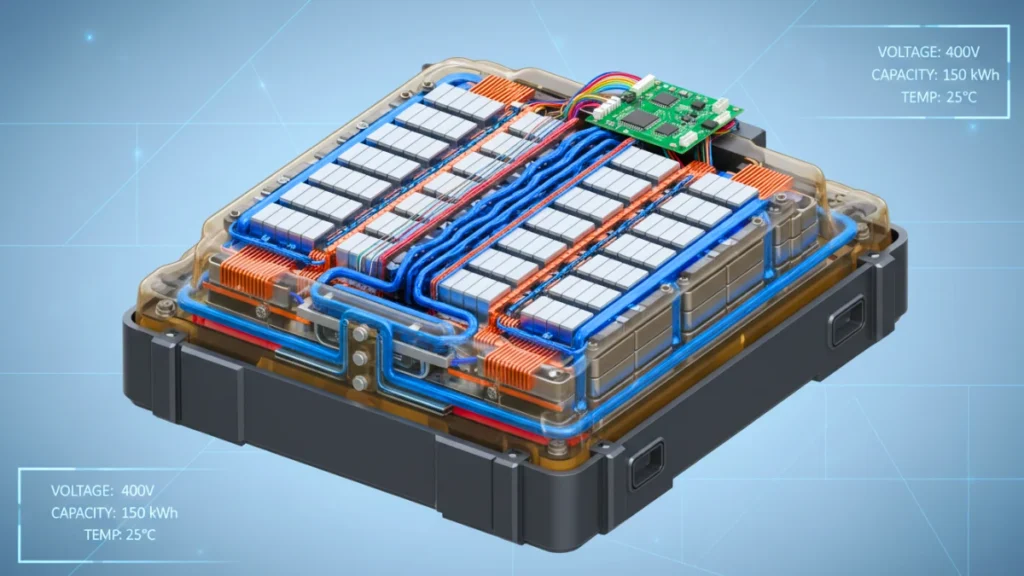

EV battery packs and next-gen cell chemistries

Why it matters: Batteries remain the single largest cost and technology differentiator for EVs. Improvements in energy density, charging speed, lifecycle, and cost per kWh directly affect vehicle range, price, and total cost of ownership.

What to look for:

- Companies producing silicon-dominant anodes, solid-state prototypes, or advanced NMC/NCA improvements.

- Battery management systems (BMS) that enable fast charging while extending calendar life.

- Vertical integration with cell manufacturing or exclusive supply agreements with automakers.

Risks: Commercial-scale solid-state breakthroughs are still uncertain; manufacturing scale and raw-material price exposure are critical.

Battery management systems (BMS) and cell-to-pack architectures

Why it matters: Smart BMS and efficient cell-to-pack designs increase usable capacity, safety, and charging performance without requiring radical new chemistries.

What to look for:

- Scalable, software-driven BMS providers with proven thermal management and cell-balancing algorithms.

- Solutions enabling cell-to-pack (CTP) that reduce module overhead and improve volumetric energy density.

- Partners across OEMs, tier-1 suppliers, or attractive retrofit markets.

Risks: Integration complexity and long product cycles with OEMs can slow commercial adoption.

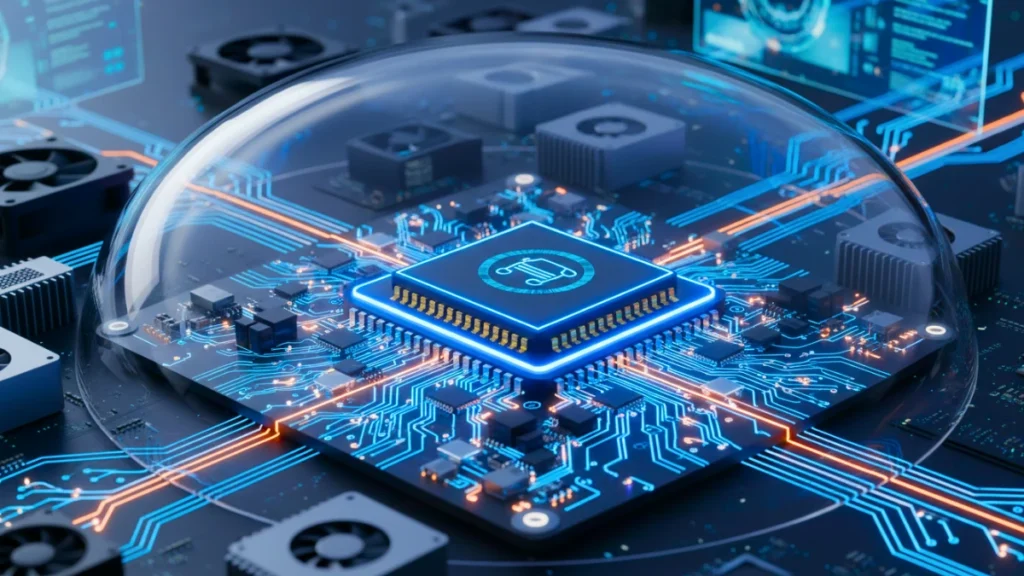

High-performance onboard compute and automotive silicon

Why it matters: Autonomous driving, advanced infotainment, and over-the-air (OTA) updates require powerful, energy-efficient automotive-grade processors.

What to look for:

- Companies delivering dedicated automotive SoCs or accelerators optimized for vision, radar/LiDAR fusion, and neural-network inference.

- Vendors with functional safety certifications (ISO 26262) and long-term supply commitments.

- Firms enabling domain controllers and zonal architectures to simplify vehicle ECUs.

Risks: Competition from giants (NVIDIA, Qualcomm) is intense; differentiation through software and partnerships matters.

LiDAR, radar, and sensor fusion stacks

Why it matters: Robust perception is essential for advanced driver-assistance systems (ADAS) and autonomous driving. Sensor fusion that combines camera, radar, and LiDAR data improves reliability across scenarios.

What to look for:

- Solid-state LiDAR providers with manufacturable price points and automotive-grade durability.

- Companies offering sensor fusion middleware and perception stacks that reduce integration burden for OEMs.

- Proven field deployments or partnerships with fleets and Tier-1s.

Risks: Redundancy strategies (using radar + camera only) could limit some LiDAR demand; performance and cost parity are key.

Over-the-air (OTA) update platforms and vehicle software suites

Why it matters: OTA updates convert vehicles into upgradable platforms, enabling recurring revenue from software features, subscriptions, and remote diagnostics.

What to look for:

- Secure, modular OTA platforms with version control, rollback, and partial module updates.

- Companies offering application marketplaces, monetization support, and analytics.

- Proven security posture and compliance with automotive cybersecurity standards.

Risks: Security breaches or poorly managed updates can harm brands; business models still vary across automakers.

Vehicle cybersecurity and secure element solutions

Why it matters: As cars become connected, they become targets. Robust cybersecurity is a regulatory and consumer requirement.

What to look for:

- Firms providing hardware root-of-trust (secure elements), intrusion detection for CAN/Ethernet, and over-the-air patching defenses.

- Vendors offering managed security services and lifecycle vulnerability management.

- Compliance with UNECE WP.29 regulations and ISO/SAE standards.

Risks: Cybersecurity is a continuous service; investors should favor recurring-revenue models and rapid threat-response capabilities.

EV charging hardware, fast chargers, and smart charging systems

Why it matters: Charging infrastructure is the backbone of mass EV adoption. Faster, more reliable charging and smart grid integration make EV ownership practical.

What to look for:

- Manufacturers of modular DC fast chargers with proven uptime and software for load balancing.

- Smart charging platforms that aggregate chargers for utilities or fleets, providing demand response and energy optimization.

- Companies enabling bidirectional charging (V2G/V2H) or wireless charging pilots.

Risks: Capital intensity, site-access challenges, and regulatory variations across regions.

Telematics, fleet management, and predictive maintenance platforms

Why it matters: Fleet operators need tools to reduce costs, improve utilization, and predict failures — especially as fleets electrify and add software complexity.

What to look for:

- Platforms combining vehicle telemetry, battery health analytics, route optimization, and predictive parts forecasting.

- SaaS models with per-vehicle pricing and modular integrations to third-party tools.

- Strong case studies with cost savings and uptime improvements for customers.

Risks: Competition from incumbent telematics players; integration and hardware-footprint challenges.

In-vehicle user experience (UX) and smart cockpit hardware

Why it matters: Consumers increasingly expect smartphone-like experiences in cars. The cockpit is now a battleground for brand differentiation and monetization.

What to look for:

- Companies building automotive-grade displays, haptics, and multi-modal UX platforms (voice + gesture + touch).

- Providers of Android Automotive OS customizations, app ecosystems, and digital services.

- Partnerships with infotainment suppliers or OEMs for production programs.

Risks: Fast shifts in consumer preferences and app ecosystems; integration cost and long OEM lead times.

Fleet electrification turnkey solutions (vehicles + charging + operations)

Why it matters: Businesses shifting to electric fleets want turnkey solutions that reduce operational friction and accelerate ROI.

What to look for:

- Companies offering integrated vehicle leasing, depot charging installation, telematics, and maintenance bundles.

- Clear TCO models showing savings versus ICE fleets and modular scalability.

- Proven pilots with logistics, last-mile delivery, or ride-hailing fleets.

Risks: Capital demands and regional regulatory differences can complicate scaling.

How to evaluate companies and products

- Product-market fit: Do the product’s features solve an urgent industry pain point? Evidence includes signed pilots, production contracts, or recurring revenue.

- Technology defensibility: Look for IP, manufacturing partnerships, and regulatory certifications that raise the barrier to entry.

- Unit economics: For hardware-heavy businesses, assess gross margins at scale. For software, examine ARPU and churn.

- Partnerships and go-to-market: Strategic relationships with OEMs, Tier-1 suppliers, fleet operators, and utilities accelerate adoption.

- Regulatory and safety compliance: Certification (ISO 26262, UNECE, etc.) and cybersecurity readiness are non-negotiable for long-term wins.

Near-term trends and tailwinds to watch

- Software-defined vehicles (SDV): Expect more features sold as subscriptions; OTA capability is a multiplier.

- Electrified commercial transport: Delivery and logistics fleets are a rapid-growth market for electrification products.

- Edge AI and on-device inference: Latency-sensitive applications (ADAS) will favor efficient edge compute.

- Standardization around domain controllers and zonal architectures: This simplifies integration and favors software-upgradable platforms.

- Energy markets interaction: V2G and behind-the-meter integration could provide new revenue streams for charging providers.

Risks and macro considerations

- Raw-material volatility: Battery supply chains remain exposed to commodity prices and geopolitics.

- Long sales cycles: Automotive procurement and validation take years; patience is required.

- Standards fragmentation: Different regional standards for charging, communications (C-V2X vs. DSRC), and safety can slow global scale.

- Competitive concentration: Large silicon, Tier-1, and OEM players can dominate key components.

Practical investment plays

- Early-stage: Startups with demonstrable pilots in BMS, solid-state materials, LiDAR manufacturability, or software platforms that lock in recurring revenue.

- Growth-stage: Companies expanding production capacity for batteries, fast chargers, or sensor modules with signed OEM contracts.

- Public markets: Established suppliers with attractive valuation, improving margins, and rising software revenue (e.g., telematics or OTA vendors).

- Strategic partnerships: Look for startups forming OEM or Tier-1 alliances — these often indicate smoother paths to scaled revenue.

Final checklist before investing

- Validate real customer adoption: pilots are good, but production contracts are better.

- Inspect the technology roadmap and manufacturing readiness.

- Demand evidence of safety and cybersecurity certification plans.

- Ensure the company can survive long lead times (solid capital runway or committed revenue).

- Confirm intellectual property and supply agreements for critical components.

Final Thought

2025 is an attractive year to invest across multiple layers of automotive technology — from cells and charging to sensors, compute, and software services. The smartest investments will favor products that reduce total cost of ownership, enable recurring revenue through software or services, and solve real operational problems for large buyers like OEMs or fleets. Evaluate each opportunity for technical defensibility, regulatory readiness, and commercial traction; those criteria will separate fleeting ideas from durable winners in the decade ahead.

FAQs – Best Automotive Technology

The most promising automotive technology products in 2025 include EV battery systems, battery management software (BMS), automotive AI chips, LiDAR and sensor fusion solutions, OTA update platforms, vehicle cybersecurity systems, EV fast chargers, and fleet electrification platforms.

2025 is pivotal due to easing battery and chip supply constraints, stricter emissions regulations, rapid EV adoption, and the profitability of software-defined vehicle (SDV) business models.

Yes. EV batteries remain critical because they represent the largest cost component of electric vehicles. Innovations in solid-state batteries, silicon anodes, and advanced battery management systems continue to drive competitive advantages.

In many cases, yes. Automotive software platforms such as OTA updates, telematics, and cybersecurity offer recurring revenue, higher margins, and faster scalability compared to hardware-only products.

Key risks include long OEM sales cycles, regulatory complexity, raw material price volatility, cybersecurity threats, and intense competition from established Tier-1 suppliers and tech giants.

OTA platforms allow automakers to monetize vehicles after sale through subscriptions, improve vehicle security, and reduce recall costs—making them attractive long-term investments.

Yes. Fleet electrification, telematics, and predictive maintenance platforms are growing rapidly due to strong ROI, government incentives, and commercial electrification mandates.